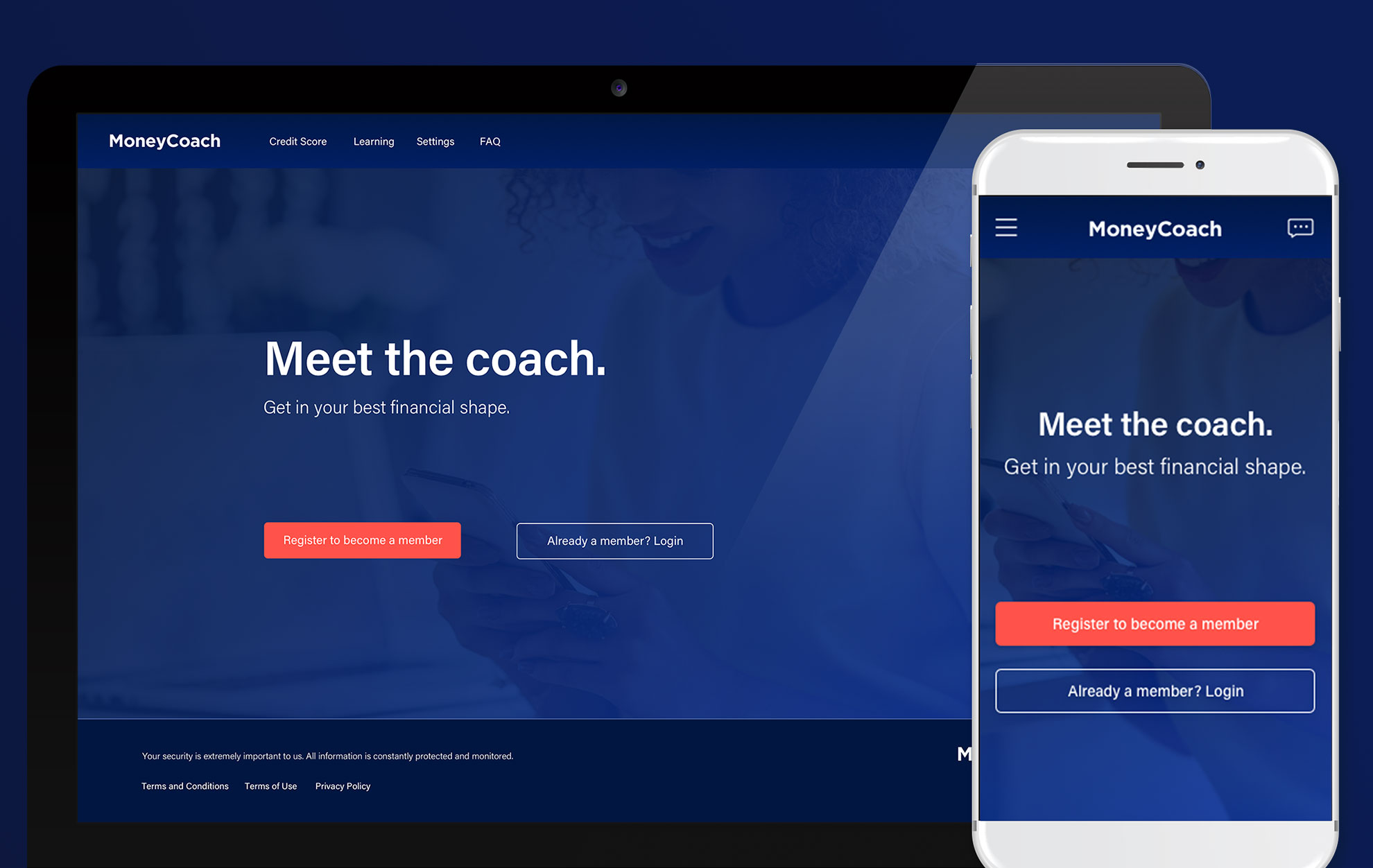

MoneyCoach

Establishing the digital banking business in South Africa and introducing the financial coach for fitness alongside other digital banking features.

PROJECT DETAILS

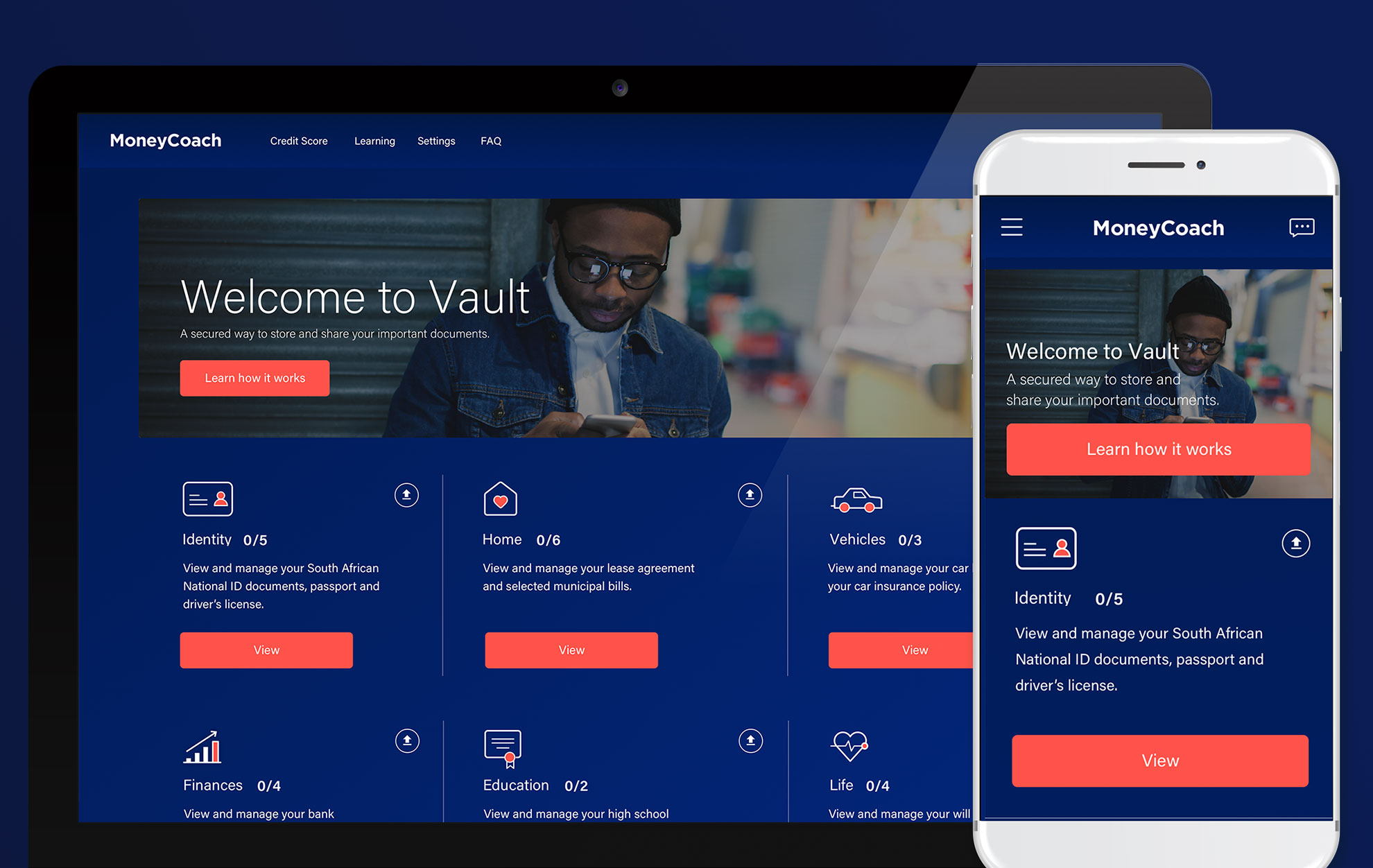

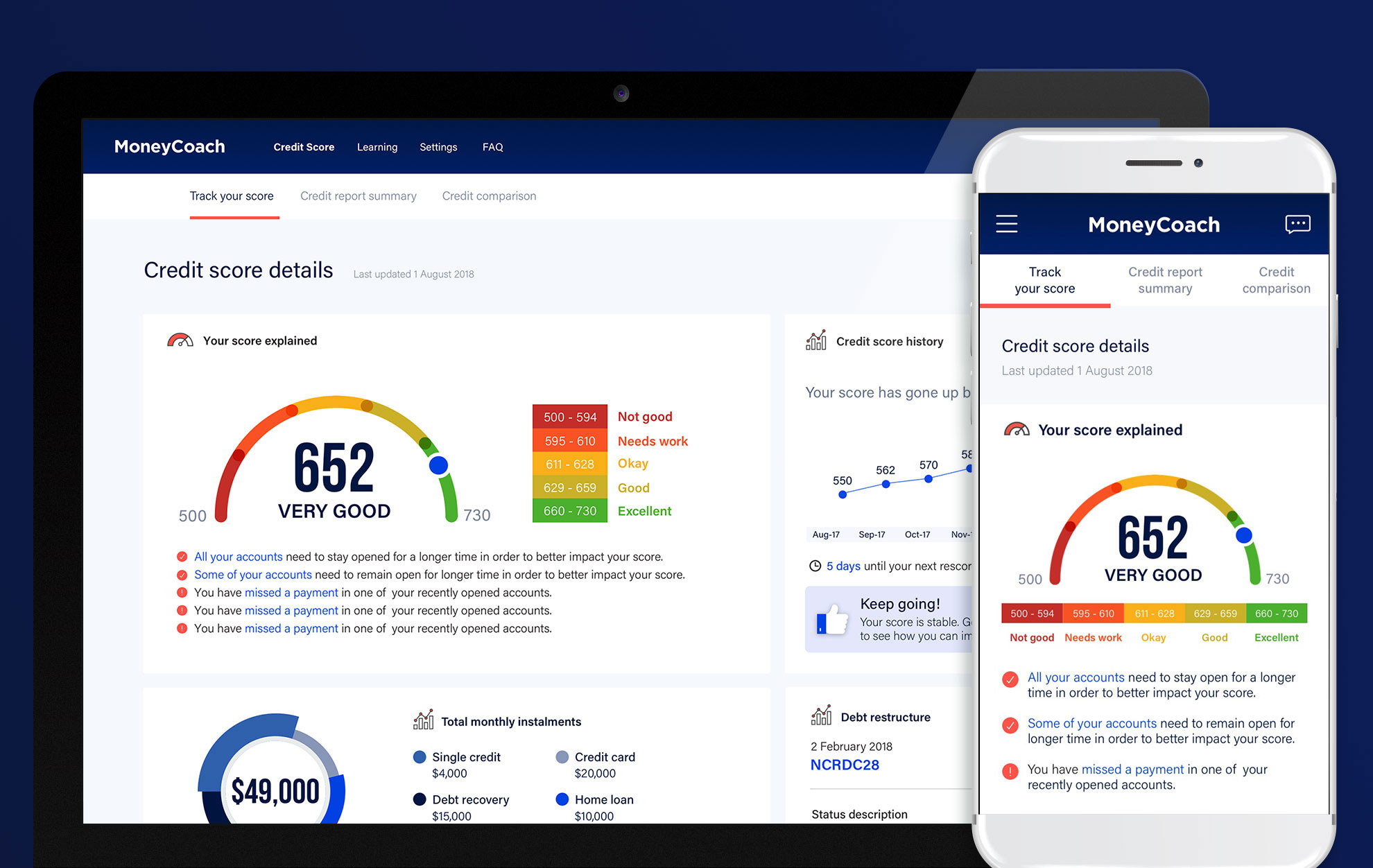

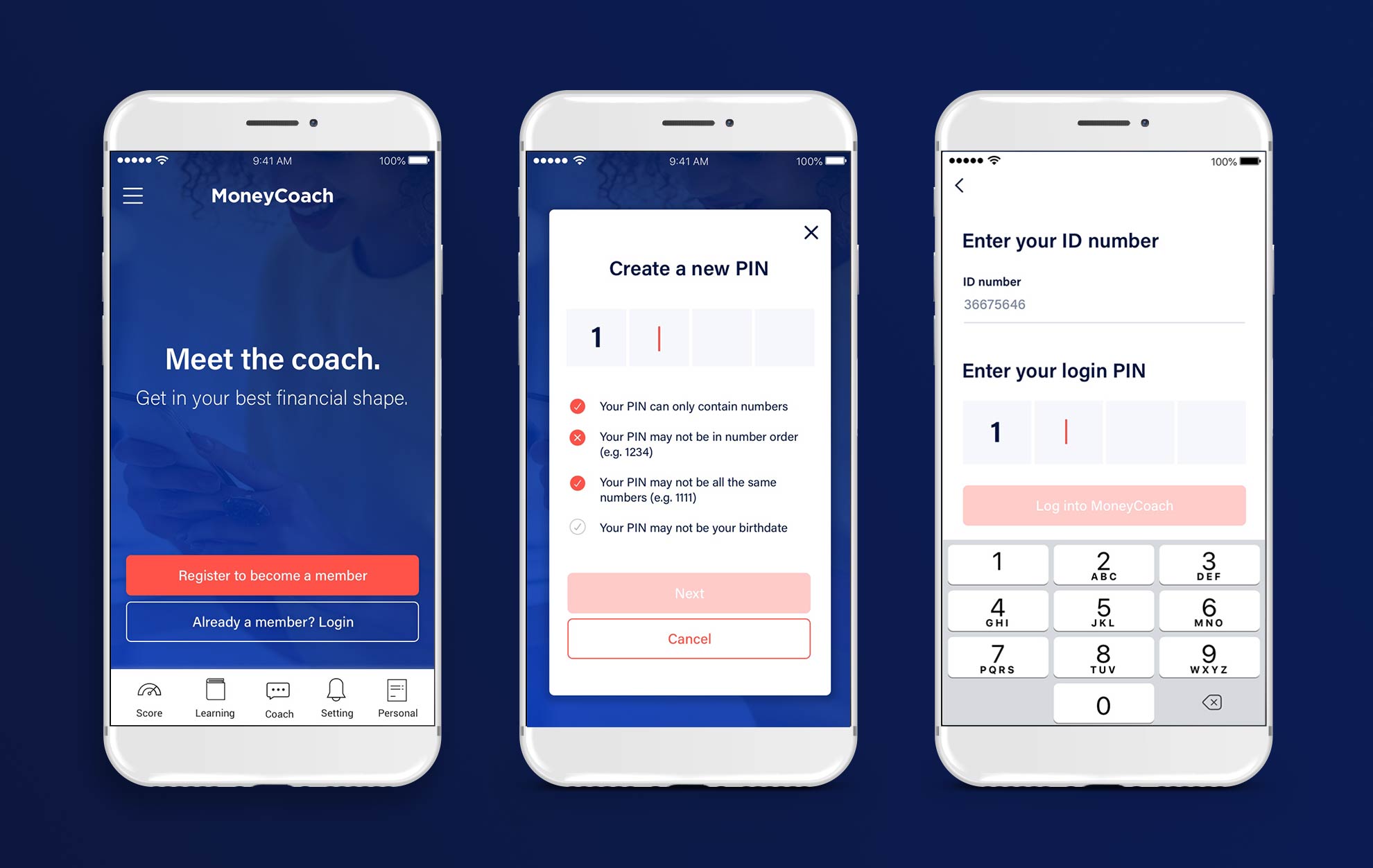

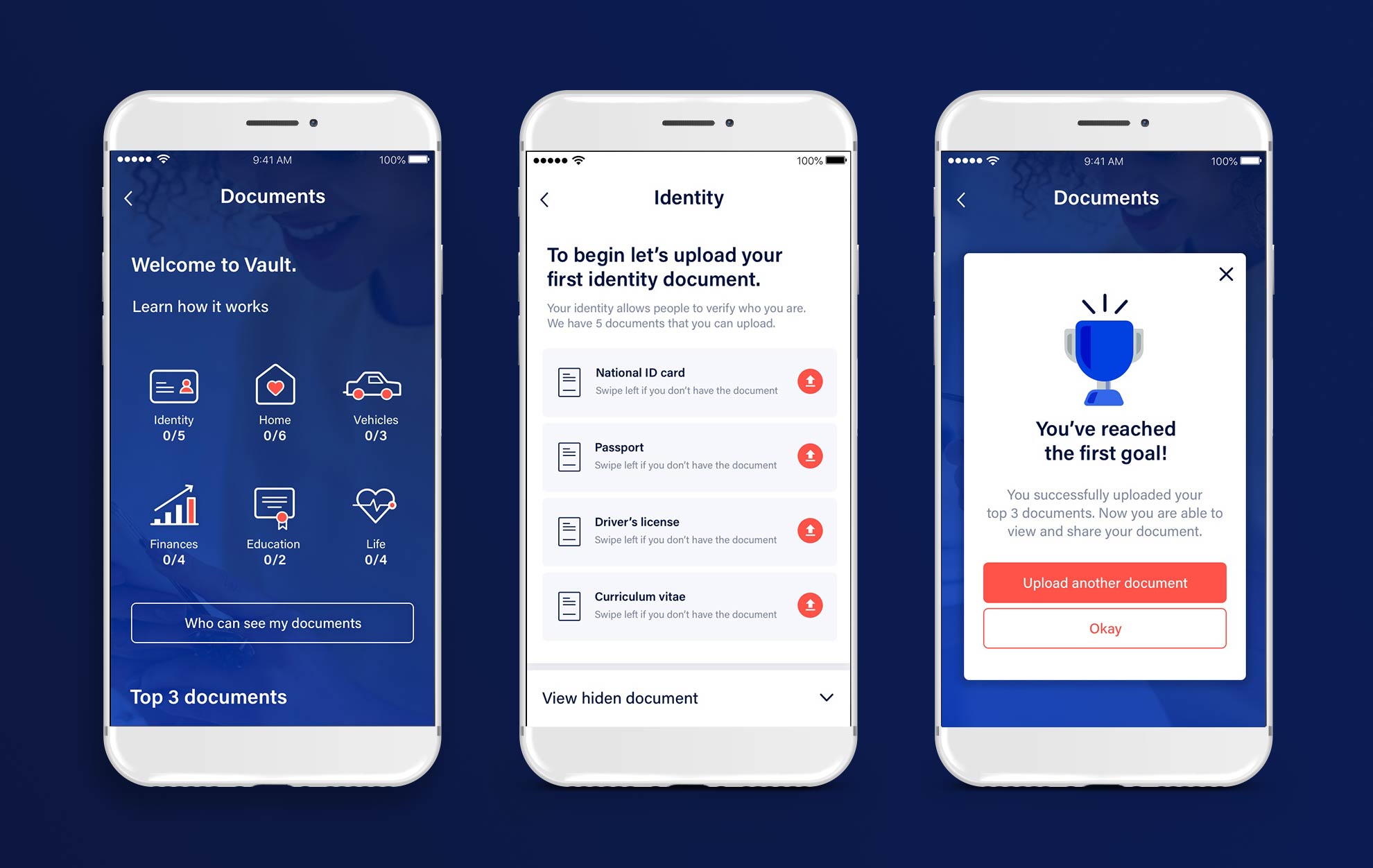

The aim was to create the first digital bank in South Africa, offering a seamless and secure user experience without the need for physical bank branches. Key aspects of the digital banking experience included the registration process for bank accounts and personal identity documentation, as well as reporting credit score indices, monthly instalments, and debt history.

The project team, located in Hong Kong, South Africa, and Vietnam, developed an agile working model that utilised an instant and responsive co-working platform for timeline and scope management, adaptation of brand library assets, and effective communication for task allocation.

SOLUTION

The project focused on making the digital banking experience intuitive and user-friendly. This involved:

- Reviewing and developing the UI/UX journeys, particularly the registration process and personal identity documentation.

- Reporting credit score indices, including the review of monthly instalments and debt history.

- Developing a mature agile working model with effective communication and task allocation across the global team.

DELIVERABLES

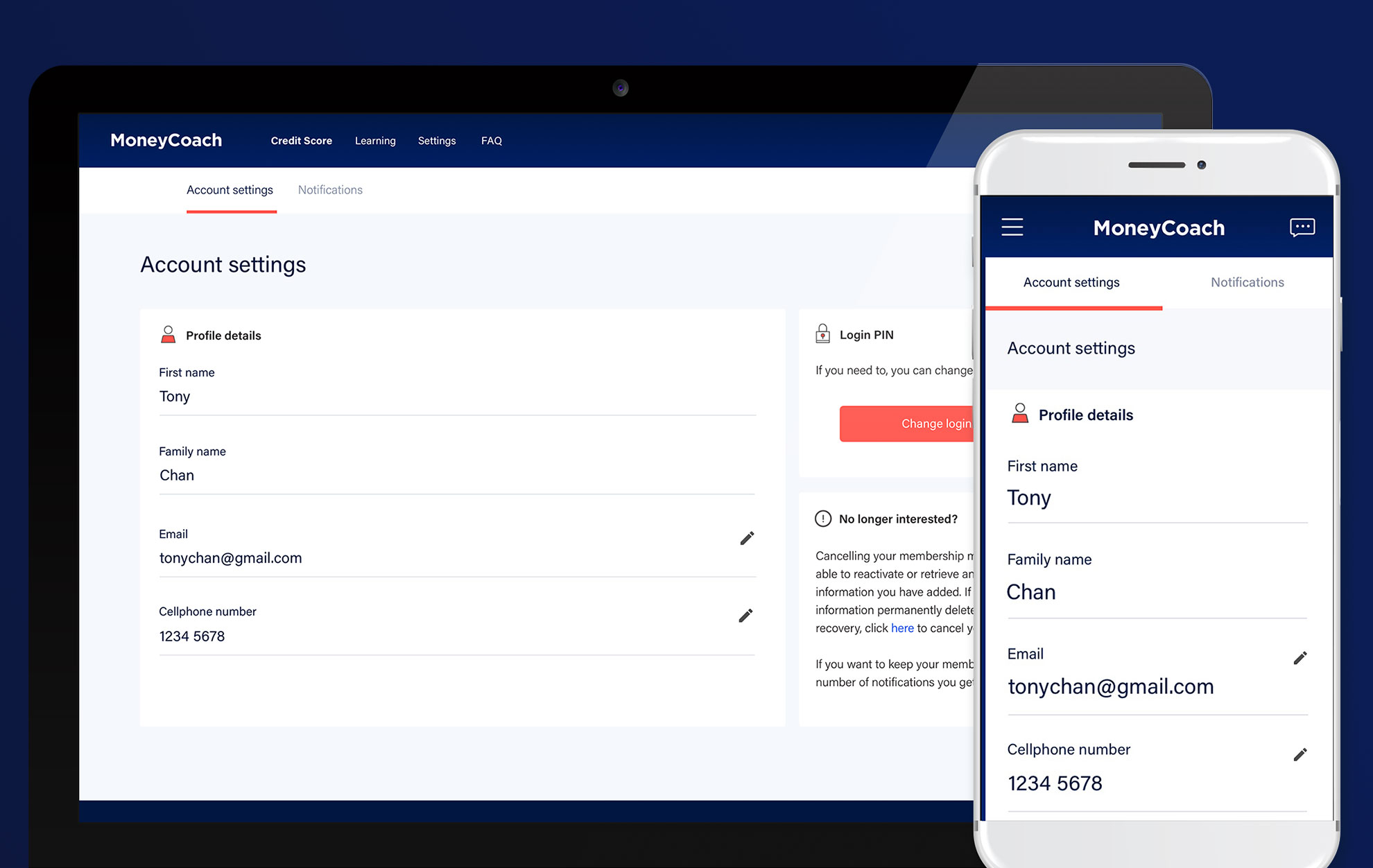

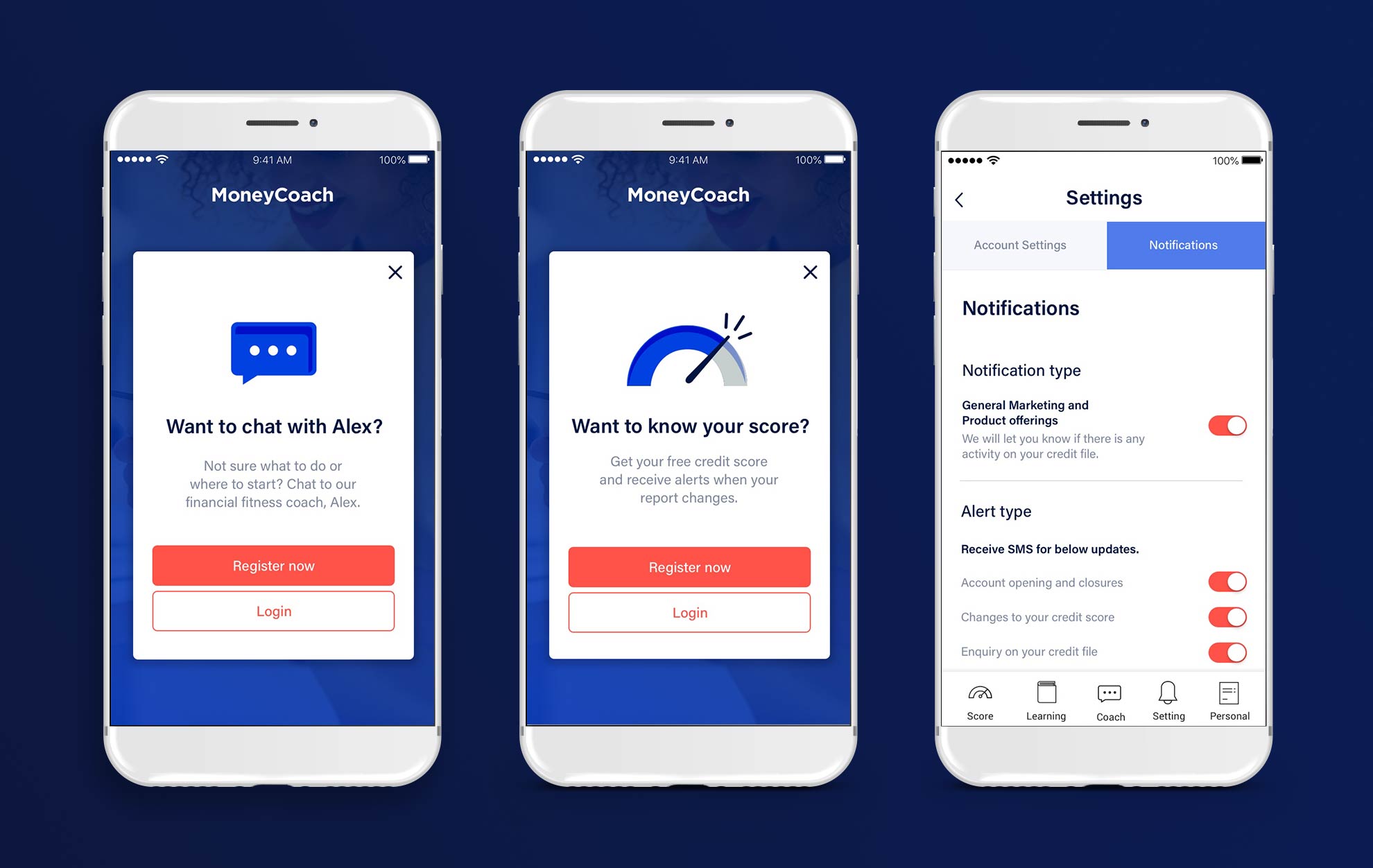

Hilly worked on UI deliverables based on wireframes drafted by the UX designer for sprints. The design teams communicated regularly to ensure brand unity and alignment of product journeys. Usability testing was carefully planned and executed regularly for in-depth reviews with South African users.

MoneyCoach, a new feature for the platform, required exploring more engaging visuals to enhance the user journey. This included animated wallpapers, friendly notification cards, and icons. Hilly executed the UI design for responsive designs of the mobile app and website interface, adhering to the existing design library and brand guidelines.

CHALLENGES

The primary challenge was catering to the target customers in South Africa while the main team was based in Hong Kong. This geographical separation made it difficult to provide instant feedback based on the local market’s initial needs. However, the South African team provided valuable insights and reflections to address this challenge effectively.

CLIENT

A digital bank in South Africa